Have you recently come across these following words: Blockchain, Bitcoin, Ethereum or NFT? Whether you heard it mentioned in a short conversation or on the news, these buzzwords have gained tremendous attention and created an aura of hype wherever they appear.

Though everything related to this technology is exciting and promising, it can get overwhelming to understand the foundations and how it plays out in the real world. To answer these questions, I want to share useful resources and thoughts to debunk the complexity.

Here’s a simple and great analogy written by William Mougayar to wrap your head around this technology - Google Docs vs. Microsoft Word

When it comes to collaborating on Word documents, you’ll need to send it over and wait for the reply with revisions, comments, etc. You have no access to the document till you receive the updated version and you are putting trust into this system to get the work done. The shift comes with Google Docs which introduces shared access to multiple parties, collaboration in real-time and visibility to everyone. This would mean that the Google doc would be the ledger (accessible to everyone) in the Blockchain and the trust then shifts from the system to the peers with access to the Google doc.

It all starts from Blockchain or also referred to as Distributed Ledger Technology (DLT) - a system of recording information (essentially a database / digital ledger) that records all transactions with an immutable cryptrographic signature (hash) and distributes across all Nodes in the network. In simpler terms - just as the name indicates, it is a database that chains together blocks of data linked with one another and shared across a network of computers to ensure transparency and accuracy of the shared information accessible on the distributed ledger.

Professor Nancy Liao at Yale University divides Blockchain in three elements. It is a technology that:

permits transactions to be gathered into blocks;

cryptographically chains blocks in chronological order; and

allows the resulting ledger to be accessed by different servers.

Distributed Ledger Technology (DLT)

When it comes to diving deep into Blockchain, it’s important to understand Distributed Ledger Technology (DLT). Blockchain is a type of DLT - which means that it is programmed to follow its guidelines.

DLT is a decentralized distributed database/ledger shared across a network of Nodes who all have access. DLT initializes a protocol or consensus mechanism to which all Nodes agree and follow.

Here is the compelling case for DLT and the distributed ledger vs. centralized ledger:

Greater transparency: All data is accessible and all individuals agree on the protocol

Easier auditability: Ownership of all transfers can be recorded

Improved speed and efficiency: Central authority not required for validation and peer-to-peer network can be faster

Cost reductions

Automation and programmability: Ownership transfer can be automated (i.e. smart contracts)

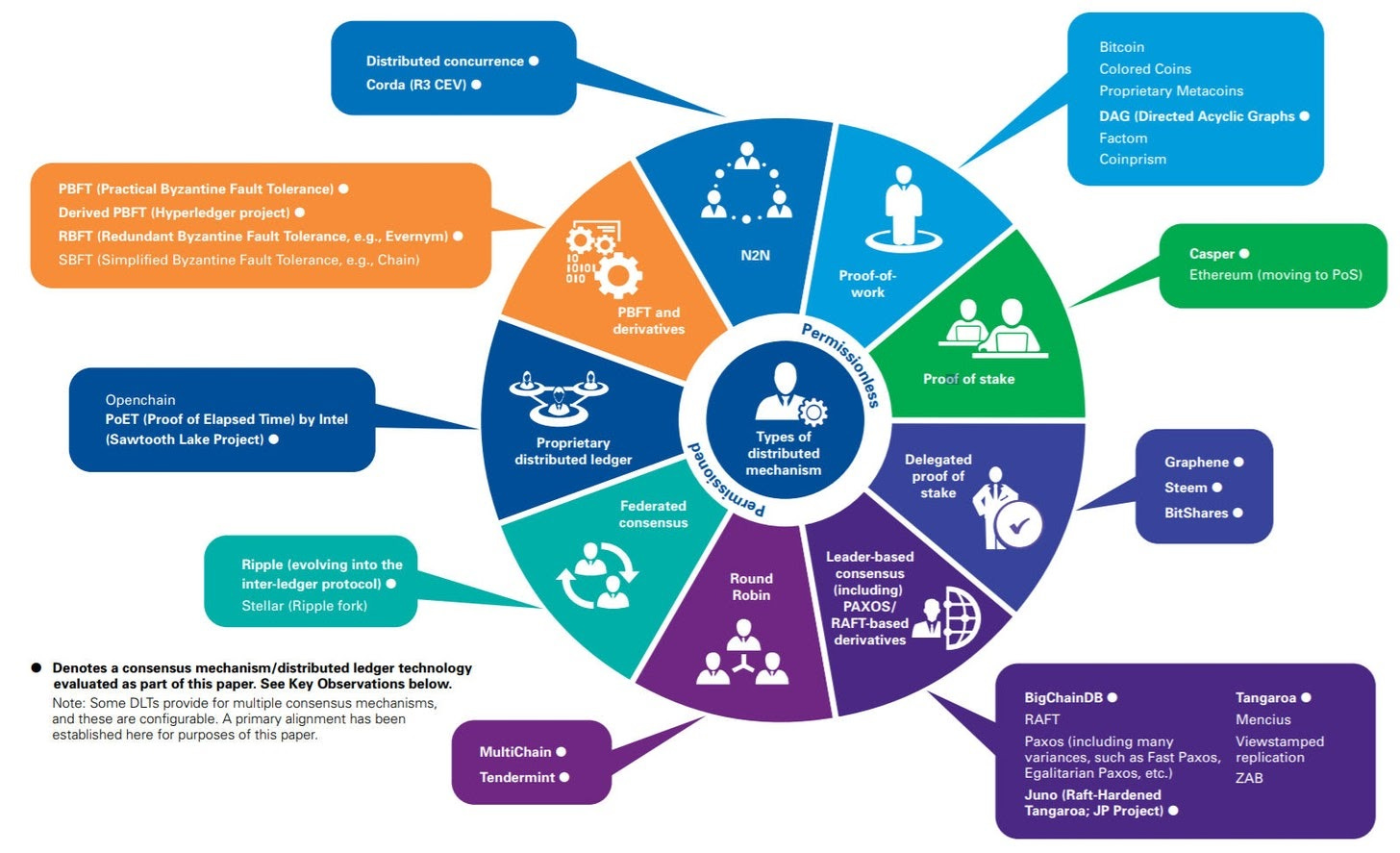

Consensus Mechanism Algorithms

This would be the trust component that is given to ensure that there is transparency in the Blockchain - to achieve the necessary agreement among distributed processes.

A decentralized, self-regulating system without a central administrator to maintain the database means the efficiency, fairness, real-time accuracy, functionality, reliability and security are essential factors given to the mechanism to provide the necessary support.

The two most common types of Blockchain consensus algorithms are Proof-of-work and Proof-of-stake.

Proof-of-work - Gives everyone the chance to solve complex mathematical (cryptographic) puzzles consisting of the effort (GPU or ASIC equipment) and luck. It can be considered a guessing game where you are competing against others to find the correct set of of numbers and receive a reward.

The common term “Mining” is used to describe Proof-of-work and it is the process of ensuring the continuous circulation of cryptocurrency (i.e. Bitcoin) allowing of the maintenance and development of the Blockchain ledger.

Proof-of-stake - Uses an election process where you will need to deposit/stake a certain amount of coins to the network and the network will randomly select a person to validate the block transactions. The more coins that you have to stake, the bigger the chance you’ll have to be chosen to validate the block and receive the reward.

The common term “Minting / Forging” is used to describe Proof-of-stake. Each node is considered “Validators” in comparison to “Miners” in Proof-of-work.

Behind the scenes

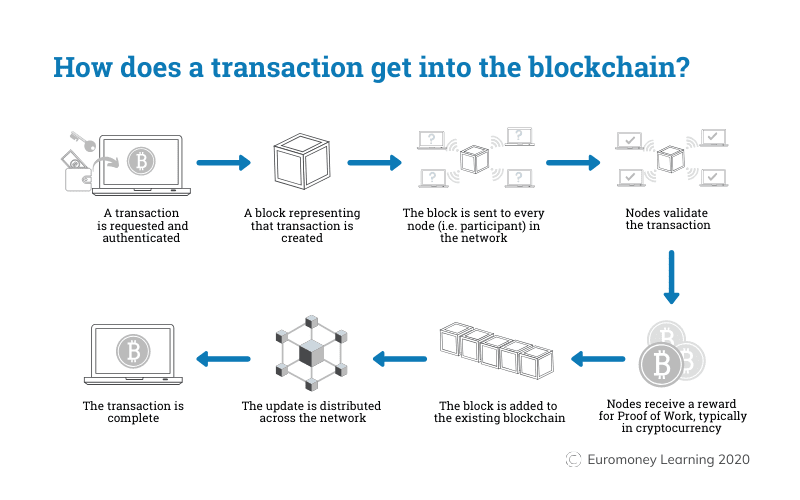

The following breaks down the process to initiate a transaction into the Blockchain:

Request: Users will initiate an action (transaction, smart contract, etc.) using their unique Digital Signature.

Broadcast: Users send transaction to a peer-to-peer computer network (Nodes).

Validation: The record would go through a network of Nodes (computers) to be properly validated through a consensus mechanism.

Verification: If the transaction is verified by the majority of the nodes, it is combined with other transactions to create a block of data for the ledger.

Acceptance: Once accepted, the record would be added to the block which would contain the hash. The block would provide the hash code of the previous block of the chain.

Distribution: The block is added to the block chain and distributed across the network, providing everyone in the network with access to see the information.

Completion: The request is complete.

Real world application

The Harvard Business Review describes this technology as “foundational”, so its integration into our society can possibly take years or decades - as a matter a fact, there’s only a few key examples of its real world application. Though its limited, the following are four examples of its usage: Cryptocurrency, Non-Fungible Token, Smart Contracts, and Supply Chain Management.

Cryptocurrency - The most popular application today. By leveraging cryptography and Blockchain technology to create a currency represented as a token. Crytocurrency started back in 2008 with the desire to create a new system that took away the centralized authority (banks) and put the trust into the peer-to-peer network. Since then, the continuous rise in value of Bitcoin and others has brought it more attention.

Non-Fungible Token (NFT) - A unique digital asset (i.e. art, graphic, drawing, music, etc.) that originated in 2014. It’s gained momentum over recent years as its become commonly used to buy and sell digital assets (i.e. art). It’s built using a programmable cryptocurrency (i.e. Ethereum) that provides a digital signature attached to each NTF. Of course, it’s also important to note that the excitement surrounding NFT’s come directly from supply and demand of the market.

Smart Contracts - This is one of the easiest applicable methods in blockchain. It is essentially a contract between two parties where everyone is anonymous, the contract is stored on the public ledger and there are specific measures in place (i.e. deadline) to self-execute the contract. Similar automation of payments can be applied to all contracts.

Supply Chain Management - Blockchain in supply chain provides optimization of flow and logistics. The challenges in supply chain consists of day-to-day operations, tracking, and trust. This provides a new layer of transparency to the entire supply chain to optimally map the path of the product - no matter the volume or the minuscule detail.

What’s in store for the future

From a technical standpoint, its possible to be in awe of the wonders it can offer. Since its drastic rise after being reintroduced with Bitcoin in 2008, its potential has been often highlighted to revolutionize societies. However, the reality is that nothing is perfect.

I believe Blockchain’s superpower derives from the shift in trust that provides greater transparency to its users. As its objective is to be a decentralized database, it takes away the central authority and enables multiple parties to use the consensus mechanism in place.

As of now, its implementation is slow and there are quite a few reasons to it. Jimmy Song provides a great overview of the costs attached to this technology:

Rigid and slow development

Difficult to design incentive structures

Users of any background

Difficulty in scaling

Upgrades aren’t required

For those large institutions that claim to use Blockchain, its also interesting to note that not all use it to the full extent of a decentralized system. Sensitive information cannot be given out to the public, therefore they often revert to a Private (Permissioned) Blockchain. This means that the network is restricted to certain participants that can access this technology when in use. It can enhance the privacy and scalability within the network, but falls through on its trust to be a decentralized system.

Going forward, the question I’m most curious to have answered - will Blockchain live up to its raging buzz and be able to fully integrate with our society? Or perhaps will it be able to truly disrupt an industry?

Resources

https://www.blockchain-council.org/blockchain/top-10-real-world-applications-of-blockchain-technology/

https://searchcio.techtarget.com/feature/Todays-blockchain-use-cases-and-industry-applications

https://antgrasso.medium.com/smart-contracts-real-life-use-cases-f1dd03a76d5

https://www.fool.com/investing/2018/03/09/smart-contracts-and-the-blockchain-explained.aspx

https://ccl.yale.edu/sites/default/files/files/A%20Brief%20Introduction%20to%20Blockchain%20(Final%20without%20Notes).pdf

https://jimmysong.medium.com/why-blockchain-is-hard-60416ea4c5c